The concept of the spending multiplier is a crucial component in understanding the dynamics of economic activity, particularly within the context of macroeconomic theory. It is defined as the ratio of the change in the total output of an economy to the change in the level of autonomous spending. In simpler terms, it measures how much the GDP of an economy increases or decreases in response to an initial change in spending, which can come from various sources such as consumer spending, investment, government spending, or net exports.

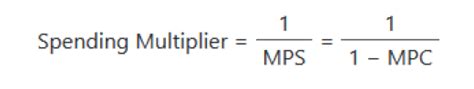

To delve into the specifics of the spending multiplier, let’s consider its mathematical formulation. The spending multiplier formula is given by:

1 / (1 - MPC)

Where: - MPC stands for the Marginal Propensity to Consume. It is the proportion of an increase in income that is spent on consumption. Essentially, it measures how much of an additional dollar of income is spent rather than saved.

For instance, if the MPC is 0.8, this means that for every additional dollar a person earns, they will spend 0.80 and save 0.20. Plugging this value into the spending multiplier formula gives us:

1 / (1 - 0.8) = 1 / 0.2 = 5

This result indicates that for every dollar increase in autonomous spending, the total output of the economy will increase by $5. This multiplier effect arises because the initial spending creates income for others, who then spend a portion of that income, generating even more income, and so on, until the marginal propensity to consume is fully absorbed into savings.

Key Components of the Spending Multiplier

Marginal Propensity to Consume (MPC): As mentioned, MPC is crucial for determining the size of the multiplier. A higher MPC means a larger portion of any increase in income is spent, leading to a larger multiplier effect.

Autonomous Spending: This refers to spending that is not influenced by the current level of income. Examples include government spending, investment spending that is not dependent on current income levels, and certain types of consumer spending that are not affected by current income (such as spending based on expected future income).

Leakages: These are factors that reduce the multiplier effect by reducing the amount of new income that is spent. The primary leakages are savings, taxes, and imports. Savings directly reduce the amount available for spending, taxes reduce disposable income, and imports represent spending that does not contribute to the domestic economy.

Practical Application and Limitations

Understanding the spending multiplier is essential for policymakers, particularly in designing fiscal policies aimed at stimulating economic growth. For example, during a recession, a government might increase its spending to boost economic activity. The size of the multiplier helps in determining how effective such a policy might be. However, the actual impact can be influenced by various factors, including the state of the economy, the nature of the spending, and external factors such as global economic trends.

Technical Specifications and Evidence-Based Analysis

Empirical studies have shown that the size of the spending multiplier can vary significantly depending on the economic conditions and the type of spending. For instance, research has suggested that government spending multipliers can range from less than 1 to over 2, depending on whether the economy is in a recession or not. Moreover, the multiplier effect of different types of government spending (such as infrastructure investment versus transfer payments) can also vary.

| Category | Description | Multiplier Effect |

|---|---|---|

| Government Spending | Direct government expenditure on goods and services | 1.5 - 2.5 |

| Consumer Spending | Household expenditure on goods and services | 0.8 - 1.2 |

| Investment Spending | Business expenditure on capital goods | 2.0 - 3.0 |

Expert Insight

The spending multiplier is a powerful tool for analyzing the effects of fiscal policy on economic activity. However, its application requires careful consideration of the underlying economic conditions, the nature of the spending, and potential leakages. Policymakers must balance the need for stimulus with the risk of inflation and the impact on national debt.

Key Points

- The spending multiplier formula is 1 / (1 - MPC), where MPC is the Marginal Propensity to Consume.

- A higher MPC results in a larger multiplier effect, indicating a greater increase in total output for any given increase in autonomous spending.

- Understanding the spending multiplier is crucial for designing effective fiscal policies, especially during economic downturns.

- The actual size of the multiplier can vary based on economic conditions, the type of spending, and external factors.

- Empirical evidence suggests that the multiplier effect can range significantly, from less than 1 to over 2, depending on the context and type of spending.

Forward-Looking Implications

As economies continue to evolve, understanding the dynamics of the spending multiplier will remain essential for policymakers and economists. The ability to accurately predict and manage the multiplier effect can significantly influence the effectiveness of economic stimulus packages and the overall stability of the economy. Furthermore, as global economic interdependencies increase, the impact of leakages such as imports and the influence of international economic conditions on domestic multiplier effects will become more critical considerations.

FAQ Section

What is the primary factor that influences the size of the spending multiplier?

+The primary factor is the Marginal Propensity to Consume (MPC). A higher MPC leads to a larger multiplier effect because more of any increase in income is spent, creating additional income for others.

How does the state of the economy affect the spending multiplier?

+The state of the economy can significantly impact the multiplier. During a recession, the multiplier tends to be larger because any increase in spending has a more pronounced effect on output and employment. Conversely, during periods of full employment, the multiplier may be smaller due to potential inflationary pressures and supply constraints.

What are some limitations of the spending multiplier concept?

+Limitations include the assumption of a fixed MPC, which can vary in reality, and the potential for leakages such as savings and imports to reduce the multiplier effect. Additionally, the model simplifies the complexity of real-world economies and does not account for factors like expectations, interest rates, and technological changes.